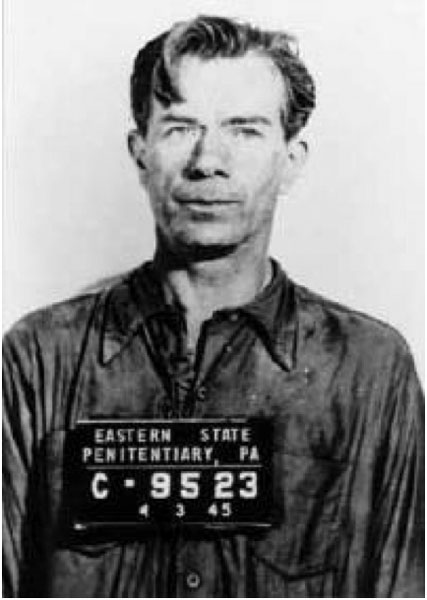

Willie Sutton robbed banks "because that's where the money is."

By The Inflation Trader

I am sure that the eurozone finance ministers have never

heard of Willie Sutton. But they are engaging now in Willie Suttonomics.

Willie Sutton was the bank robber from the early part of the 20th century who, when asked why he robbed banks, reputedly answered "because that's where the money is!" This weekend, the Troika agreed to extend a critical loan to Cyprus in order to stave off a default for the small eurozone nation. The €10 billion ($13.7B) loan was extended on condition that bank depositors be levied 6.75% or 9.9% of their deposits (the lesser amount if under €100,000 ($130,795) as part of the solution, and the new president of Cyprus said he accepted because he was given no choice.

I fail to see how this differs from what Willie Sutton did, except that Sutton at least went to prison - multiple times - for the crime. You went into the bank on Thursday and your deposits read €20,000 ($26,159) as you were saving for a new car, or a house, or college; on Monday, you have €18,650 ($24,393). It is being called, disingenuously, a "tax," but considering that no Cypriot body approved the "tax", it is hard to see how that appellation fits. The money vanished from the vault with no warning. That seems more like a bank robber's job…except that ordinarily, when a bank is robbed the depositors are protected. The depositors would have been better off if the money had been stolen by Willie Sutton!

My son, who is 9 years old, saw it the same way when I explained the basic facts of what happened to the depositors. He said "that sounds like something Lex Luthor would do." From the mouths of children…and I don't judge him wrong on this.

On Monday, I imagine that markets will try and behave as if this "puts the crisis behind us" again. But also on Monday, I imagine that every corporate Treasurer who has money in a bank in Europe will be trying to diversify those deposits to other jurisdictions. Perhaps, if I am such a treasurer, I will pull money from Italy to put into Germany or perhaps I will put it into U.K. or U.S. banks. But one thing I certainly will not do is leave all of it in a bank in Italy, or Portugal, or Hungary, or Spain.

It is possible that nothing will happen, or at least not right away as stunned European depositors wait to find out if it's really true, and some dwell in denial. But it's also possible that we could see the mother of all bank runs, because it's no longer necessary for depositors to stand in long lines to withdraw their cash, as happened in every major banking crisis that happened before deposit insurance. This is exactly the opposite of deposit insurance - instead of the government protecting depositors, the government is opening the vault for the robbers.

Now, it's not completely approved as of this writing. According to Reuters, the Cypriot parliament will vote on Sunday whether to mug depositors for the levy. But, since the alternative is that Cyprus will have to default on Tuesday, the odds are good that either they'll approve the levy (which banks have already sequestered, without any law to tell them to do so), or there will be some 11th hour brinkmanship with the Troika and Cyprus on Monday. But by Tuesday, you will either have the disorderly default of a eurozone member, or confiscation of deposits held in banks of a eurozone country. Now that's a Hobson's choice if ever there was one.

Here are some stories elsewhere about the crazy Troika scheme: here, here, and here. And I rarely cite Zerohedge but here is a good summary of some quotes from well-placed individuals in Europe. Comfortingly, the response so far has been shock and anger. Most observers are, rightly, dismissing the soothing statements that this action is an "exception." Yes, it is - a confiscatory exception, and one that was completely random and unforeseeable by the depositors. Does it make one feel better that the crazy man on the street just set his neighbor's car on fire, if he says "but it's just his car - no one else's." No, because you know he's a crazy man, and now you know there is nothing he won't do. Random injustice is worse than systematic injustice.

Hold on to your assets, folks - I have no idea what happens on Monday but I have a feeling it will require more liquidity. But then, doesn't everything these days?

Related Reading:

Fanatics Who Will Do Anything To Save The Euro

Daylight Bank Robbery In Cyprus Will Haunt The EMU

Cyprus Offers A Scary Economics Lesson For America

Willie Suttonomics

The Rape of Cyprus

Cyprus and the Death of Deposit Insurance

The Extraordinary Thing Is That There Hasn't Yet Been A Bank Run Across The Mediterranean

After Cyprus Bank Bailout, Depositors Race To Withdraw Their Cash. Is The Rest Of Europe Next?

Monumental Deceit: How Our Politicians Have Lied And Lied About The True Purpose Of the European Behemoth

The EU's Insidious War On The Nation State Must Be Halted

Václav Klaus Warns That The Destruction Of Europe's Democracy May Be In Its Final Phase

Bubble Times: 20 Facts About The Collapse Of Europe That Everyone Should Know

The UK to the EU: Eeeeeew! Go Away!

Europe's Double Dip Teaches A Lesson About Taxes

A Message To Leftists In The UK & US From Sweden

Suicide-By-Demographics, Post #3,209,598

Leavin' Here: Escape From The E.U.S.S.R.

(European) Union Power!

Über Alles After All

There's No Such Thing As A "Permanent" Tax Cut

Immigration & The Town That Stopped Mincing Words

Hitler's Ghost Haunts Europe

A Lib Dem Gives Voice To Britain's National Sickness

The American People Voted For Big Government. Now, Let Them Pay For It!

Willie Sutton was the bank robber from the early part of the 20th century who, when asked why he robbed banks, reputedly answered "because that's where the money is!" This weekend, the Troika agreed to extend a critical loan to Cyprus in order to stave off a default for the small eurozone nation. The €10 billion ($13.7B) loan was extended on condition that bank depositors be levied 6.75% or 9.9% of their deposits (the lesser amount if under €100,000 ($130,795) as part of the solution, and the new president of Cyprus said he accepted because he was given no choice.

I fail to see how this differs from what Willie Sutton did, except that Sutton at least went to prison - multiple times - for the crime. You went into the bank on Thursday and your deposits read €20,000 ($26,159) as you were saving for a new car, or a house, or college; on Monday, you have €18,650 ($24,393). It is being called, disingenuously, a "tax," but considering that no Cypriot body approved the "tax", it is hard to see how that appellation fits. The money vanished from the vault with no warning. That seems more like a bank robber's job…except that ordinarily, when a bank is robbed the depositors are protected. The depositors would have been better off if the money had been stolen by Willie Sutton!

My son, who is 9 years old, saw it the same way when I explained the basic facts of what happened to the depositors. He said "that sounds like something Lex Luthor would do." From the mouths of children…and I don't judge him wrong on this.

On Monday, I imagine that markets will try and behave as if this "puts the crisis behind us" again. But also on Monday, I imagine that every corporate Treasurer who has money in a bank in Europe will be trying to diversify those deposits to other jurisdictions. Perhaps, if I am such a treasurer, I will pull money from Italy to put into Germany or perhaps I will put it into U.K. or U.S. banks. But one thing I certainly will not do is leave all of it in a bank in Italy, or Portugal, or Hungary, or Spain.

It is possible that nothing will happen, or at least not right away as stunned European depositors wait to find out if it's really true, and some dwell in denial. But it's also possible that we could see the mother of all bank runs, because it's no longer necessary for depositors to stand in long lines to withdraw their cash, as happened in every major banking crisis that happened before deposit insurance. This is exactly the opposite of deposit insurance - instead of the government protecting depositors, the government is opening the vault for the robbers.

Now, it's not completely approved as of this writing. According to Reuters, the Cypriot parliament will vote on Sunday whether to mug depositors for the levy. But, since the alternative is that Cyprus will have to default on Tuesday, the odds are good that either they'll approve the levy (which banks have already sequestered, without any law to tell them to do so), or there will be some 11th hour brinkmanship with the Troika and Cyprus on Monday. But by Tuesday, you will either have the disorderly default of a eurozone member, or confiscation of deposits held in banks of a eurozone country. Now that's a Hobson's choice if ever there was one.

Here are some stories elsewhere about the crazy Troika scheme: here, here, and here. And I rarely cite Zerohedge but here is a good summary of some quotes from well-placed individuals in Europe. Comfortingly, the response so far has been shock and anger. Most observers are, rightly, dismissing the soothing statements that this action is an "exception." Yes, it is - a confiscatory exception, and one that was completely random and unforeseeable by the depositors. Does it make one feel better that the crazy man on the street just set his neighbor's car on fire, if he says "but it's just his car - no one else's." No, because you know he's a crazy man, and now you know there is nothing he won't do. Random injustice is worse than systematic injustice.

Hold on to your assets, folks - I have no idea what happens on Monday but I have a feeling it will require more liquidity. But then, doesn't everything these days?

Related Reading:

Fanatics Who Will Do Anything To Save The Euro

Daylight Bank Robbery In Cyprus Will Haunt The EMU

Cyprus Offers A Scary Economics Lesson For America

Willie Suttonomics

The Rape of Cyprus

Cyprus and the Death of Deposit Insurance

The Extraordinary Thing Is That There Hasn't Yet Been A Bank Run Across The Mediterranean

After Cyprus Bank Bailout, Depositors Race To Withdraw Their Cash. Is The Rest Of Europe Next?

Monumental Deceit: How Our Politicians Have Lied And Lied About The True Purpose Of the European Behemoth

The EU's Insidious War On The Nation State Must Be Halted

Václav Klaus Warns That The Destruction Of Europe's Democracy May Be In Its Final Phase

Bubble Times: 20 Facts About The Collapse Of Europe That Everyone Should Know

The UK to the EU: Eeeeeew! Go Away!

Europe's Double Dip Teaches A Lesson About Taxes

A Message To Leftists In The UK & US From Sweden

Suicide-By-Demographics, Post #3,209,598

Leavin' Here: Escape From The E.U.S.S.R.

(European) Union Power!

Über Alles After All

There's No Such Thing As A "Permanent" Tax Cut

Immigration & The Town That Stopped Mincing Words

Hitler's Ghost Haunts Europe

A Lib Dem Gives Voice To Britain's National Sickness

The American People Voted For Big Government. Now, Let Them Pay For It!

No comments:

Post a Comment